A Guru Overview of Dyches Boddiford, Veteran Real Estate Investor and Educator

Described by one commentator as “one of the most creative investors in the country,” Dyches Boddiford has been involved with real estate investing for over 35 years.

With an impressive academic background in physics, Boddiford (his unusual first name is pronounced like the Dutch dams) scored a job as an electrical engineer as his first career move, despite having no specific background in the field.

Even while enjoying that work, Boddiford discovered his true love a couple of years later, and the rest is history.

After getting his start with a couple of rental properties around 1980, he became a full-time investor a decade later, earning in his first year more than he had as a Vice President in the engineering industry.

Since then, Boddiford has become one of the most recognized and respected players of all in the field of real estate investing.

The first class he taught for the Georgia Real Estate Investors Association (GREIA) in 1992 launched him off in a productive new direction, while he remains even today an active, hands-on practitioner of the innovative but well-grounded strategies he teaches to others.

His site Assets101.com is a top destination for those interested in advanced real estate investing and associated topics, with a wide selection of Boddiford-penned courses and books to choose from.

Boddiford is also a frequent speaker at investment clubs, seminars, and even investment-oriented cruises and the like, delivering the kinds of actionable, informed, no-nonsense information that most benefits investors, while always doing so with a unique, creative flair.

But even with his overwhelmingly positive background and education, I say….

>I’m OUT<<

I found a better way that wasn’t so capital intensive and didn’t cause me to leverage everything I own in hope of nailing down a rental contract or being able to flip the property to someone else while skimming off some cash for the next deal.

I’m gonna continue on with the review in a sec…but first I want to tell you something IMPORTANT.

I tried the tight-rope act and fell without a safety net, (so you can’t blame me, feel me?)….just a little to badly burned on the REI deal and was looking for a better way.

I met James and some other people. They showed me how to kill my job, get rid of the life drain and get on with living.

I realized there was a different way to generate the type of income I wanted.

For me this is an intervention….uh hem…. sorry to tell you that.

I wish someone would have told me about this before I lost it all in real estate…just sayin’

You can read my story if you want, here. The real estate game gave me a black eye. It doesn’t have to give you one.

Back to the review.

Let’s talk about Dyches Boddiford’s Books and Training

Preserving Privacy and Assets through the Strategic Use of Land Trusts

Boddiford first made waves with his GREIA talks on land trusts in the early 1990s, and he is today regarded, along with Robert Pless, as one of the pioneers of that class of strategies.

While Pless focused on how properly constructed trusts could benefit corporations, Boddiford made a strong case for their use by individual real estate investors, adding to the collective toolbox a powerful tactic that is even more popular twenty-plus years later.

In fact, this topic is the basis for some of Boddiford’s best-attended contemporary talks, with recent days seeing him enlighten listeners as to “The Truth about Trusts” at the North San Diego Real Estate Investors Association and elsewhere.

As is common with his work, the basic Dyches Boddiford land trust approach is to make sure that every potential pitfall is identified from the start, so that these can be worked around in ways that allow for the maximization of the instrument’s usefulness.

Although not every investor will want to employ land trusts, those who do so properly can count on greatly improved personal privacy and, frequently, far better protection of their hard-earned assets, making the related publication one of the most popular Dyches Boddiford books to date.

Real-Estate Investing for Retirement: Boddiford’s Take on Self-Directed IRAs

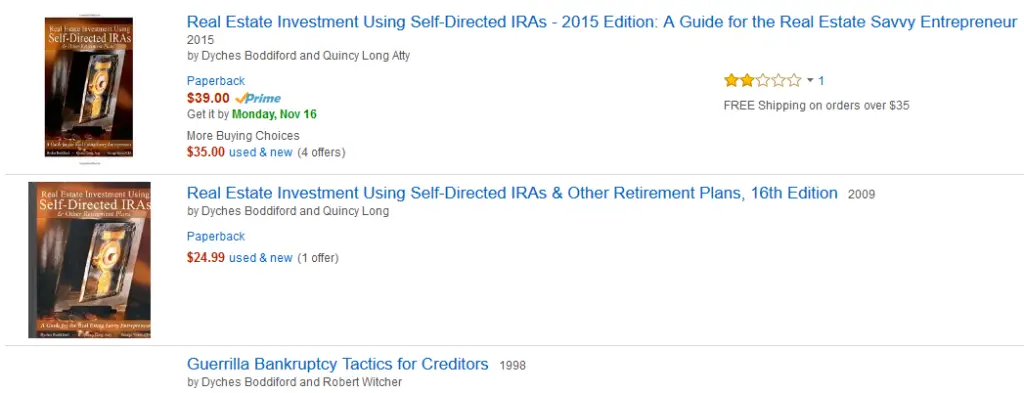

On top of evolving his approach to longtime interests like land trusts, Boddiford is well known as someone who is always looking for new challenges and solutions. Just this year, he put out an updated version, with co-author Quincy Long, of Real Estate Investment Using Self-Directed IRAs, tackling a topic of increasing interest in the wider investing community.

Like a lot of Boddiford’s efforts, this latest publication strives to give readers all the fundamental grounding they could hope for, while still delivering plenty of distinctively idiosyncratic, unique advice that cannot be found elsewhere.

Because the IRS’s rules about self-directed IRAs and prohibited transactions are so complex and thorny, many investors come to feel that it’s better to stick with more traditional investment approaches.

By tackling the subject in such an empowering way, Boddiford endows readers with the kind of confidence that can enable them to leverage the impressive returns possible through real estate investing for their own retirement portfolios.

Low-Risk Hard-Money Lending for Investors

Even while being an avid purchaser of property himself for many years, Boddiford has maintained a longtime interest in helping others finance their own projects.

In fact, this work has proven to be consistently profitable for him over the years, and a number of recent Dyches Boddiford seminars have focused on this style of investing.

So-called “hard money” lending happens when the creditor attempts to secure a loan purely on the basis of the market value of the collateral, not worrying about the borrower’s income, credit history, or other traditional indicators of worthiness.

In the real estate sphere, Boddiford has been making waves showing how veteran investors can use their accumulated expertise and capital to extend highly profitable short-term loans to others while exposing themselves to very little risk.

Naturally enough, succeeding in this kind of work does require doing plenty of research, including as to the foreclosure procedures in particular states and the competitiveness of the local lending environment.

Once again, though, Boddiford has been teaching investors how preparation and clear-eyed decision-making can open up some attractive new opportunities.

Boddiford’s Present-Day Reputation and Status

In a field where just about everyone seems to attract a share of criticism and negativity, Boddiford stands as one of the few with a basically unblemished record.

Rarely one to over-promise or hype himself beyond what he has to offer, he consistently attracts strong reviews and praise.

One recent attendee of a talk he gave in California, for example, described him as a “class act” and observed that “the best in the business take classes from him.”

When he does come under fire, it tends to be of a generally genteel sort, as with an in-depth, highly technical open letter that another land trust expert published regarding what the writer regarded as Boddiford’s somewhat simplistic advice about the legal tool.

The fact is, of course, that minor criticism of that kind is to be expected for those who take such pains to explain complicated, intricate subjects so that others with less experience can put them to use in practice.

What no one seems ever to have claimed about Boddiford is that he is a scam artist or someone who gets by on self-promotion.

Instead, he has built up an impressive third career teaching others the things he has learned in the course of excelling at his second.